In a globalized world, where economic boundaries are increasingly fluid, Brazil stands out as a promising destination for international investments. With its vast territorial expanse, wealth of natural resources, and a diverse and entrepreneurial population, this South American country offers a vibrant business environment full of opportunities.

The Brazilian economy, one of the largest in the world, is characterized by a complex mix of modernity and traditions, innovation, and a deep respect for its rich cultural heritage. Companies from across the globe looking to expand their operations or explore new markets find fertile ground in Brazil, not just because of the economic opportunities it offers, but also due to the receptiveness and cultural diversity that characterize this country.

However, doing business in Brazil, like in any international market, presents unique challenges. From navigating a complex legal and tax system to understanding cultural nuances in business practices, foreign companies face a learning curve when entering the Brazilian market. In this context, specialized legal and business advisory becomes not just useful, but essential for success.

This article compiles the experience of Vanzin & Penteado Advogados law firm in structuring foreign companies in Brazil, offering a comprehensive overview of the most important aspects of doing business in Brazil. We will cover everything from the economic and political landscape to specific legal aspects, such as company incorporation, the tax system, labor laws, and the crucial understanding of the RADAR system for international trade. Our goal is to provide a detailed and practical guide, enabling foreign companies to navigate successfully and confidently in the dynamic Brazilian market.

Firstly, when considering business expansion to Brazil, it is essential to understand the country's economic and political landscape, both fundamental for devising effective market strategies. Brazil, being the largest economy in Latin America and one of the largest in the world, presents a diversified economic scenario full of opportunities. Characterized by a robust agricultural sector, an expanding manufacturing industry, and a growing service sector, Brazil is not just an agricultural giant but also an important industrial and technological hub.

In recent years, the Brazilian economy has shown signs of recovery and stabilization, after periods of economic turbulence. This growth is driven by a series of structural reforms aimed at increasing competitiveness and attractiveness for foreign investments. The country also benefits from vast natural resources, which continue to attract significant investments in sectors such as mining, energy, and agriculture.

From a political standpoint, Brazil is a democracy with multiple political parties. The Brazilian political landscape, though sometimes volatile, has shown a capacity for resilience and adaptation. Recent political and economic reforms have been implemented with the goal of improving governance, increasing transparency, and strengthening the economy. These changes reflect a commitment to stability and the continuous improvement of the business environment, crucial aspects for foreign investors.

Macroeconomic stability, driven by a solid monetary regime and responsible fiscal policies, has been one of Brazil's strengths. Additionally, the country has been striving to create a more business-friendly environment, with improvements and simplification of bureaucratic processes and incentives for innovation and technological development.

However, it is crucial to be aware of existing challenges, such as the complexity of the tax system and the nuances of local regulations. Additionally, companies must be prepared to navigate an environment that, although in the process of reform, still presents certain political and economic instability.

In summary, the economic and political landscape of Brazil is a mosaic of opportunities and challenges. With a growing economy and a constantly evolving political environment, Brazil presents itself as an attractive and promising market for foreign investments. A deep understanding of this context is essential for the success and sustainability of business operations in the country.

At first glance, forming a company in Brazil is a process that requires understanding and attention to various legal aspects, essential for ensuring compliance and the success of operations. Foreign investors and entrepreneurs must be particularly aware of the main types of corporate entities, the mandatory nature of having a manager, and the need to have a legal representative in Brazil.

In Brazil, the most common types of corporate entities for businesses are the Limited Liability Company (Ltda) and the Corporation (S.A.).

3.2.1 ) Mandatory Requirement for a Company Manager

A crucial point in the formation of a company in Brazil is the appointment of a manager, who can be a partner or a third party, with powers to manage and represent the company. However, there are some legal requirements for the manager::

For foreign partners, it is essential to appoint a legal representative residing in Brazil. This legal representative will be responsible for:

3.2.3 ) Other Relevant Aspects

Besides these points, foreign entrepreneurs and investors should consider:

Establishing a company in Brazil involves a series of legal challenges. However, with the right guidance and a clear understanding of the legal requirements, structuring and operationalization can be done correctly, efficiently, in compliance with local legislation, which avoids expenses on rework, actions by regulatory agencies, and fines due to mistakes in the process.

The Brazilian tax system is known for its complexity and dynamism, representing a significant challenge for companies, especially foreign ones, seeking to establish or expand their operations in Brazil. Understanding this system is key to ensuring tax compliance and optimizing the company's tax burden.

4.1.1 ) Main Taxes:

4.1.2 ) Tax Regimes:

In summary, the Brazilian tax system, with its peculiarities, even considered to be one of the most complex in the world, is a crucial component to be considered by any company wishing to operate in Brazil. A thorough understanding and effective management of taxes are essential for the success and sustainability of business operations in the country.

Brazilian labour law is characterized by its breadth and complexity, and is a crucial aspect for foreign companies seeking to operate in Brazil. In short, this field governs relations between employers and employees, establishing rights and obligations for both parties.

However, understanding these rules is vital to ensuring legal compliance and promoting a balanced working environment.

Labor legislation in Brazil is based on the Consolidation of Labor Laws (CLT), which details a wide range of issues, from working hours to rights such as vacations, 13th salary and prior notice. As such, employment contracts can vary, including modalities for time:

i) indefinite period;

ii) Fixed-term, and;

iii) temporary.

The legislation favors job stability, and termination without just cause can result in significant compensation.

Employers in Brazil have a number of obligations, such as adhering to the standard working day of 44 hours a week, paying labor rights, including paid vacations and the 13th salary, as well as FGTS and INSS contributions. It is also their responsibility to ensure a safe and healthy working environment, complying with health and safety regulations.

The hiring of employees, whether local or foreign, is regulated by specific rules. Foreign workers need proper work visas and companies must observe certain quotas for the proportion of local workers to foreigners. Hiring processes must respect principles of equality and non-discrimination.

Business culture in Brazil has its own peculiarities, with a management style that values personal relationships and a collaborative working environment. Adapting to this culture is important for effective management and for establishing productive working relationships.

Due to the complexity of labor laws, the guidance of professionals specializing in labor law is essential. They can help interpret the rules, ensure legal compliance and provide strategic guidance for managing employment relationships.

In synthesis, labor law in Brazil, with its specificities, represents a challenging field, but one that can be managed with the right knowledge and legal support. In this way, an informed and careful approach can not only minimize legal risks, but also contribute to creating a harmonious and motivating work environment.

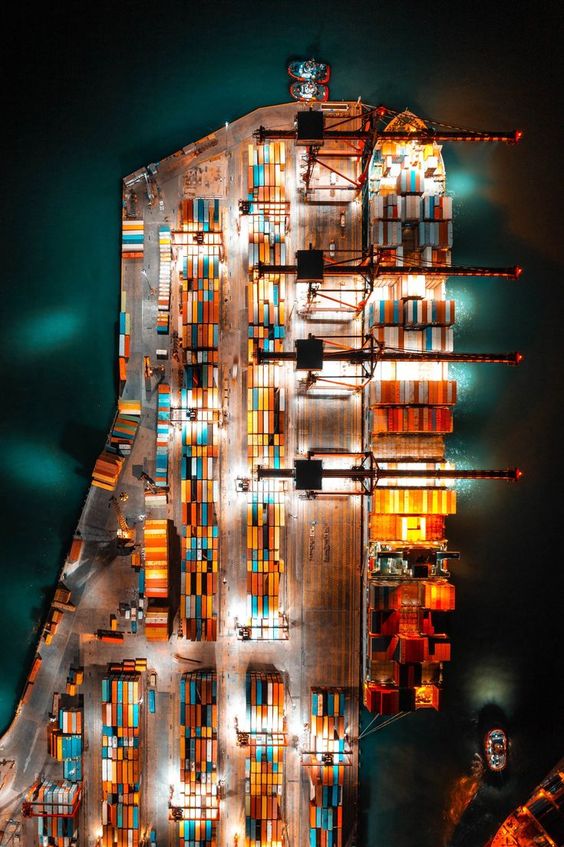

For foreign companies interested in the Brazilian market, it is essential to understand the regulation of international trade and investment in the country.

Brazil has a specific regulatory system that governs these areas, with agencies such as the Central Bank of Brazil (BACEN) and the Securities and Exchange Commission (CVM) playing crucial roles.

Brazil's regulatory system is complex and involves several government and regulatory agencies. The rules and regulations are detailed and can vary considerably depending on the industry. For foreign investors, it is essential to have a thorough knowledge of these regulations to ensure smooth operations and legal compliance.

Therefore, the regulation of international trade and investment in Brazil is a fundamental aspect that requires detailed attention on the part of foreign companies. A thorough understanding of the role of bodies such as BACEN and CVM, as well as adherence to sectoral and foreign exchange regulations, is crucial to ensuring successful operations and compliance with Brazilian legislation.

The RADAR system is vital for international trade in Brazil. This segment explores in depth the process of obtaining RADAR, differentiating between Limited and Unlimited RADAR, and discusses how SISCOMEX works, highlighting the importance of this system for efficient import and export operations.

For foreign companies planning to engage in import and export activities in Brazil, understanding and navigating the RADAR system is essential. RADAR, which stands for "Registro e Rastreamento da Atuação dos Intervenientes Aduaneiros", is a system implemented by the Brazilian Federal Revenue Service to control foreign trade operations.

This system is the key to accessing SISCOMEX (Integrated Foreign Trade System), which is the Brazilian government's electronic platform for processing all import and export activities.

There are mainly two types of RADAR clearance, each suitable for different volumes of operations:

*equivalent to Internal Revenue Service (IRS)

Accordingly, given the complexity of the process of obtaining RADAR and the importance of ensuring compliance with all customs regulations, the assistance of professionals specializing in international trade and customs law is strongly recommended.

As a result, the RADAR system is a crucial component of foreign trade operations in Brazil. For foreign companies, understanding and qualifying for this system is an indispensable step towards efficiently accessing the Brazilian import and export market.

In the Brazilian business landscape, the protection of intellectual property and personal data are aspects of paramount importance, especially for foreign companies seeking to operate in the country. Brazil has specific legislation to protect intellectual property and, more recently, implemented the General Data Protection Law (LGPD), influenced by the European Union's General Data Protection Regulation (GDPR), to regulate the collection and processing of personal data.

In other words, intellectual property protection and compliance with the LGPD are essential for companies operating in Brazil, especially those dealing with technology, personal data and intellectual property. Thus, understanding and adhering to these regulations is essential to ensure safe and sustainable operations in the Brazilian market.

Vanzin & Penteado Law Firm, with more than 26 years of experience in business and international law, has advised several foreign companies on establishing their operations in Brazil, as well as achieving success in the country through strategic analysis, corporate structuring, representation, contractual instrumentation, tax, regulatory and commercial consultancy.

The following are some of the firm's most recent cases, which can be shared, and reflect both its know-how and its ability to create creative and innovative solutions for clients:

Timely, a Canadian company, entrusted Vanzin & Penteado Law Firm with the task of developing data protection and information security policies. These policies were compliance requirements for one of the company's prospects, FIFA (Fédération Internationale de Football Association).

With a strong combination of legal knowledge of all the applicable laws and regulations, as well as a technical understanding of the context, Vanzin & Penteado's specialist lawyers developed all the documents and ensured that Timely not only complied with the legislation, but also met the standards requested by FIFA and closed the contract with this major player in the market. FIFA continues to be Timely's client today.

Updairy, an innovative Singaporean company, faced the challenge of launching its operation in Brazil. Vanzin & Penteado played a crucial role in the legal structuring of this venture, from planning, setting up a Brazilian subsidiary, assisting with the transfer and legalization of foreign funds, and providing strategic advice at all stages. The result was Updairy's quick, smooth and effective entry into the Brazilian market.

LuckCatch, a Hong Kong company, sought the expertise of Vanzin & Penteado to structure its operation in Brazil. The legal services offered were: study and planning of the legal and tax impacts, legal representation of the company and shareholders, as well as the structuring of contracts. The work ensured that LuckCatch not only established its presence in Brazil, but also operated with full legal compliance and operational efficiency.

Thinking about the journey of setting up a project and operating in the Brazilian market, it is clear that foreign companies face an environment full of peculiarities and potentialities. In a nutshell, this article sought to cover fundamental aspects such as the economic and political landscape, the legal framework for setting up companies, the complexities of the tax system, the nuances of labor law and international trade and investment regulations, as well as the growing importance of intellectual property and the protection of personal data, especially in light of the LGPD.

Despite the challenges, Brazil offers fertile ground for foreign companies, with significant opportunities in various sectors. The key to success lies in the ability to adapt and engage deeply with the Brazilian business context, capitalizing on the unique opportunities the country offers.

In conclusion, Brazil represents both a challenge and an opportunity for foreign investors. With a well-informed, adaptive and legally aware approach, companies can not only overcome obstacles, but also thrive in this dynamic and promising market. Vanzin & Penteado Law Firm is prepared to be a strategic partner in this journey, offering the expertise and support needed to successfully navigate Brazil's complex but rewarding business environment.

Publicado por:

© 2024 Vanzin & Penteado Advogados Associados.